Solar Loan

A solar loan is the primary means used by most people to finance their energy independence. Taking out a loan to pay for your system allows you to leave your savings account alone and instead start putting money in it each month by using all-time low interest rate loans. You also can qualify for the 30% Residential Renewable Energy Tax Credit to immediately reduce your energy costs.

With a solar loan, you can go solar with no money out of pocket and a monthly payment lower than what you are currently paying your utility for the same energy. Or, you can keep supporting your utility and the fossil fuels industry and ever increasing rates. We think the choice is pretty clear.

A credit score of 700 or higher is required to secure a loan, which can run for a term of 12 or 20 years.

- No money out of pocket

- Lower payments than current utility bill

- 30% tax credit

- Own your system

12 Year Solar Loan

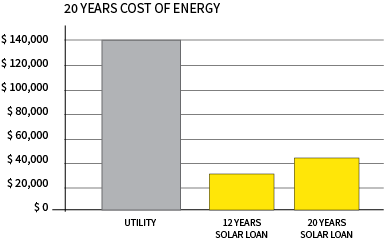

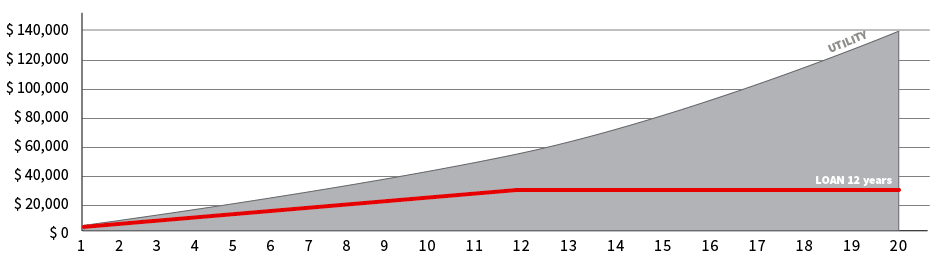

The chart below represents a sample of the cumulative cost of buying a 7-kilowatt Sunpower solar system with a 12-year loan compared to staying with your local power utility over a 20-year period. The savings and costs shown are samples for a typical Southern California homeowner and not necessarily representative of what you would pay or save by going solar. The pricing and savings in the chart are just estimates and should not be considered a quote of pricing from Sullivan Solar Power.

One line shows the costs of financing your solar power system with a loan paid off over 12 years. The other line represents the rising costs of power bought from your local utility.

With a 12-year loan, the monthly payments are slightly higher than they would be with a 20-year loan, but over the life of the loan, the 12-year term results in a much lower overall cost because less interest is paid. Additionally, the 12-year loan has monthly payments that are less than what you are paying the utility now.

With this financing option, you can go solar, pay less, own your system, secure a tax credit for 30% of your system’s cost and pay off the loan in 12 years. We feel this is a no-brainer.

The 12-year loan payback period results in a total cost of $31,916 compared to a utility cost of $139,663, for a savings of $107,747.

Your Solar Options

If you want to pay your system off as fast as possible with no money down, own your system and stop paying the utility rising energy costs, the 12-year solar loan likely is your best option. To minimize your monthly payments and still own your system, the 20-year might be a good option.

If you are not eligible for a solar loan due to your credit history or you don’t want to take out any personal debt in your name, then financing through the Property Assessed Clean Energy (PACE) program may be a good option.